What Are Commodities?

Commodities are raw materials or agricultural products that can be bought, sold, or traded. They’re the basic building blocks of the global economy.

When you fill up your car, shop for groceries, or even build a house, commodities are involved.

They are essential for survival and economic stability. Every industry, from farming to technology, depends on them.

Major Categories:

- Agriculture: Crops and livestock

- Energy: Oil, gas, renewables

- Metals: Gold, silver, copper, aluminum

Read also : Things need to Know about construction

Key Commodity Types

Agricultural Commodities

Agriculture feeds the world — and the markets.

Main agricultural commodities include:

- Grains: Wheat (Gehun), Basmati Rice (Basmati Chawal), and Multan Rice (Chawal)

- Vegetables: Potato (Aloo), Onion (Pyaaz), Tomato (Tamatar), Cucumber (Kheera), and many more

- Fruits: Banana (Kela), Watermelon (Tarbooz), Guava (Amrood), Papaya (Papita), and Strawberry

Livestock like cattle and poultry also fall into this group.

Energy Commodities

Without energy, economies stop moving.

Key energy commodities are:

- Oil: Still the king of global energy

- Natural Gas: Powers homes and industries

- Renewables: Solar, wind, and biofuels gaining ground

(Image suggestion: Pie chart showing global energy sources — oil, gas, renewables.)

Metals

From jewelry to skyscrapers, metals are everywhere.

Precious metals: Gold, silver, platinum

Industrial metals: Copper, aluminum, nickel

Each plays a crucial role in modern living.

Other Essential Raw Materials

Other often-traded items include pulses and grains like Moong Dal (Moong Pulse), Chana Dal (Gram Pulse), Masoor Dal (Masoor Pulse), and sugar (Shakkar).

Even items like Garlic (Lehsan), Ginger (Adrak), and Bitter Gourd (Karela) influence local commodity pricing.

Learn More :

How Commodity Markets Function

Commodity markets run on simple supply and demand. When supply drops or demand jumps, prices move.

It’s not random. It’s driven by real-world needs and shortages.

Traders, farmers, governments, and investors all play roles.

Price Determination:

- Harvest size

- Political tensions

- Shipping logistics

Major Global Exchanges:

- New York Mercantile Exchange (NYMEX)

- London Metal Exchange (LME)

- Chicago Board of Trade (CBOT)

(Suggested data: Table listing major exchanges and what commodities they specialize in.)

Price Influencers

1- Weather Events

A drought can wipe out crops like Cabbage (Patta Gobhi), Ghiya (Zucchini), or Shaljam (Turnip).

Heavy rains can ruin fields of Capsicum (Shimla) and Beet (Chukandar).

Weather shifts are often the first domino in commodity markets.

2- Geopolitical Factors

Wars, sanctions, and unrest choke supply lines.

Oil and gas are especially vulnerable.

A blocked shipping route can send energy prices soaring within hours.

(Suggested chart: Timeline of major geopolitical events and their impact on oil prices.)

3- Economic Conditions

Inflation, currency values, and national growth rates shift demand.

When money’s tight, people buy fewer expensive foods like Dates (Khajoor) and Kinnow (Santra).

When economies boom, construction spikes — and so does demand for metals.

4- Technology Changes

Farming tech can boost yields for crops like Okra (Bhindi) or Bottle Gourd (Kadoo).

Energy tech can reduce oil dependence by boosting renewables.

When technology improves, some commodities become cheaper and more abundant.

5- Commodities in Everyday Life

Everyday commodities shape your shopping list and your wallet. When wheat prices rise, bread costs more. When oil prices spike, so does gasoline.

It’s a direct connection from the fields and mines to your home.

Practical Examples:

- Tomato (Tamatar) shortages send ketchup prices climbing.

- Poor potato (Aloo) harvests mean more expensive fries.

- Gold price jumps affect jewelry costs during wedding seasons.

Commodity markets aren’t far-off places.

They shape your budget every day.

(Suggested infographic: “Farm to Table” — show how wheat becomes bread, oil becomes gasoline, etc.)

Current Market Trends

Recent Price Movements

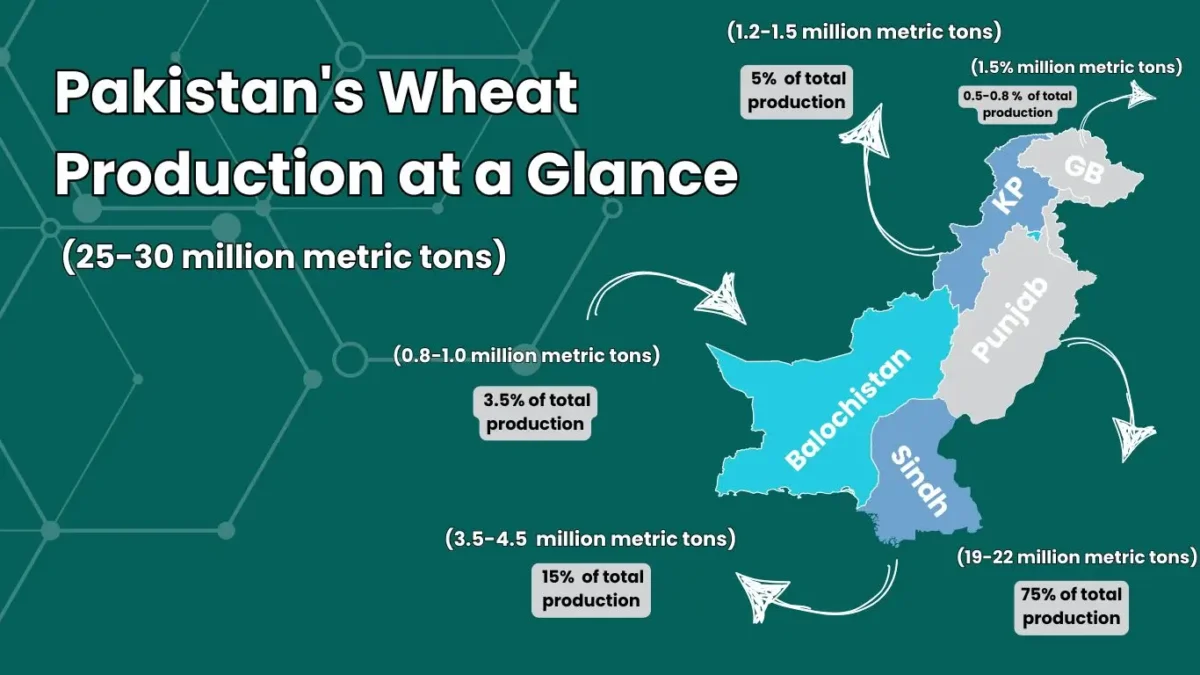

In the past year, global wheat (Gehun) and sugar (Shakkar) prices saw notable hikes.

Energy markets remained volatile with oil swinging between high and moderate prices.

Vegetable markets fluctuated sharply due to unpredictable weather, especially for crops like Spinach (Palak) and Radish (Mooli).

(Suggested data chart: Year-on-year percentage change in key commodity prices.)

Emerging Commodity Markets

New players are entering:

- Renewable energy sources

- Sustainable agricultural crops

- Niche metals like lithium for electric cars

Markets for items like organic Garlic (Lehsan) and local Guava (Amrood) are also growing in popularity.

Sustainability Considerations

Sustainability isn’t a trend — it’s becoming the norm.

Farming practices for vegetables like Brinjal (Baingan) and Cabbage (Gobi) are shifting toward organic and low-pesticide methods.

Energy giants are investing heavily in solar and wind power.

Consumers demand eco-friendly products — and companies are responding.

Looking Forward

Technology Impacts

Precision farming could mean better, cheaper crops like Lady Finger (Bhindi) and Pumpkin (Kaddu).

Energy storage advances could reshape oil and gas demand.

Smart contracts on blockchain might change how commodities are bought and sold.

(Suggested graph: Predicted adoption rates of renewable energy sources to 2030.)

Environmental Factors

Climate change will continue to rattle markets.

Unstable growing seasons could affect common foods like Sweet Potato (Shakarkandi) and Watermelon (Tarbooz).

Floods, droughts, and storms will become price drivers more than ever.

Short-Term Predictions

Expect moderate volatility across energy, metals, and agriculture.

Staple food items like Onion (Pyaaz), Carrot (Gajar), and Coriander (Dhania) could see minor price fluctuations, especially during off-seasons.

Gold might maintain steady demand as a safe-haven asset.

Conclusion: Why Commodities Matter to Consumers

Commodities aren’t just market charts or trade deals. They decide what you eat, wear, and pay for daily.

Understanding commodity basics helps you make smarter choices.

It gives you power in your purchases — from buying groceries to fueling your car.

Whether it’s Garlic (Lehsan) in your kitchen or Gold in your investments, commodities shape your life in ways you feel every day.

Key Takeaways:

- Commodities are essential raw materials.

- Their prices depend on weather, politics, and technology.

- They affect everything from food bills to housing costs.